How to Budget for An Apartment in Chicago in 2025

With inflation and the cost of living on many minds, apartment-related budgeting is crucial to being proactive and protective of your finances. In this guide, we will highlight why budgeting is critical, especially now, and walk you through ways to save and spend strategically.

The Effects of Inflation

Over the past years, people nationwide have felt the impact of inflation. We have seen the cost of living drastically increase, with food, labor, rent, gasoline, food and more rising.

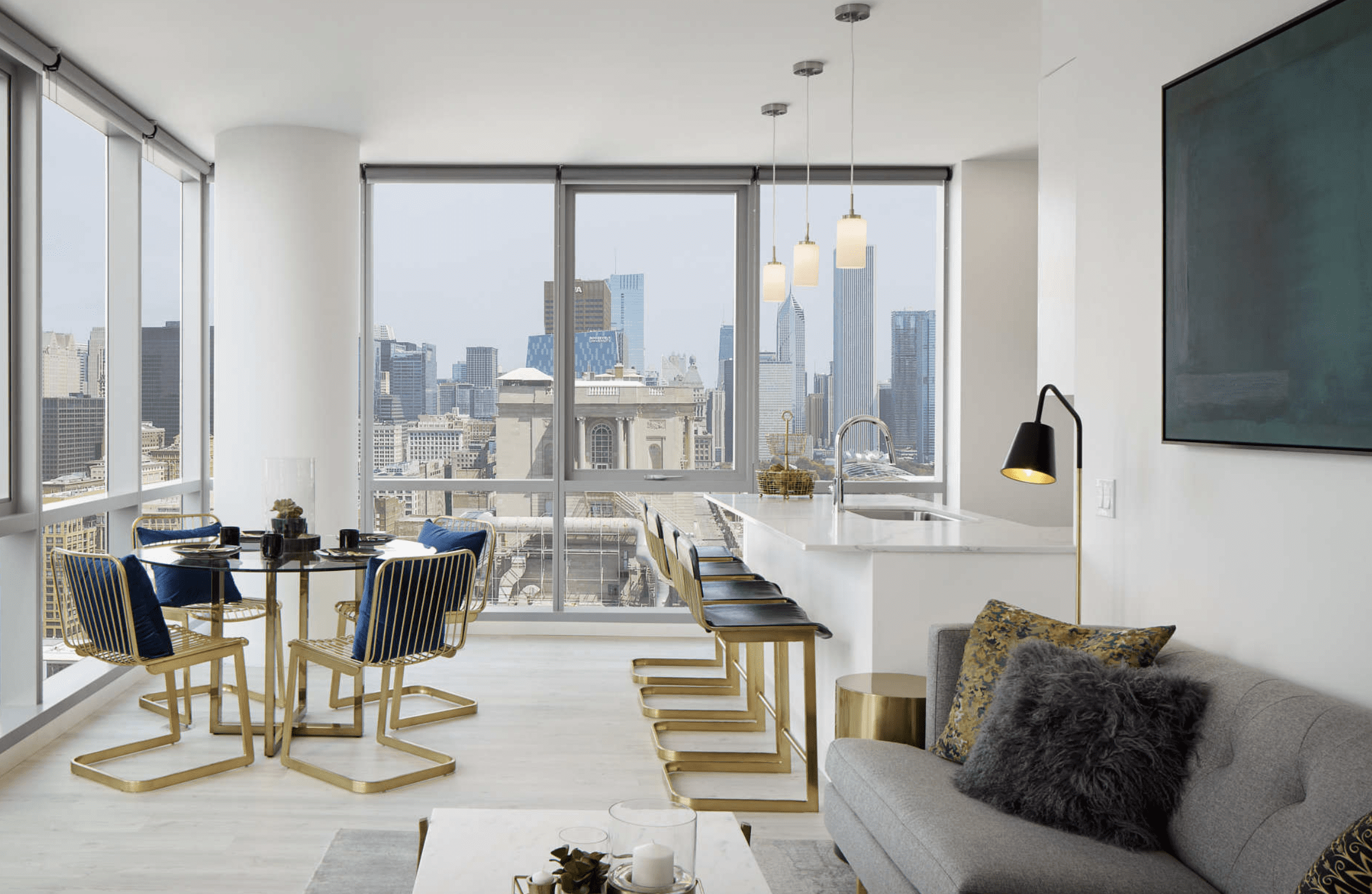

Towards the end of 2023, the median rent for a one-bedroom apartment in Chicago was $1,385, up almost 24% compared to the same time last year and 10% higher than the national median. The CoStar Risk Analytics national forecast suggests that Chicago apartment rental prices can expect significant hikes in early 2024.

To compensate for these higher prices, renters should be extra mindful of their spending. Setting a budget is one of the first ways to set yourself up for financial success.

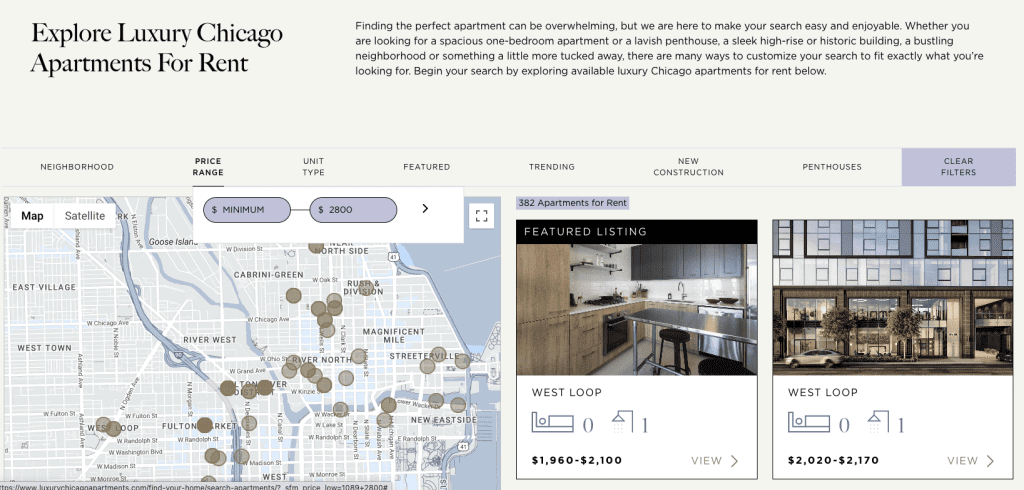

Calculate Rent

Before beginning the apartment hunt, know what monthly rent you can swing. A common budgeting standard for rent is the 30% rule, which advises not spending more than 30% of your monthly income before taxes (your gross income) on rent.

Let’s say your monthly paycheck is $6,000. The 30% rule would mean that you should scope out apartment listings for $1,800 or less a month.

Cover Moving Costs

As you budget money to cover the move to a new apartment, keep these costs in mind:

- Move-in fees: These are non-refundable charges associated with the leasing process and can include application and administrative costs. The typical move-in fee in Chicago ranges between $425 to $700. Be sure to discuss these costs with the property manager or landlord before signing your lease.

- Security deposit: This is a form of insurance for landlords against potential damages that are paid before moving in and returned if the apartment is in sufficient condition at the end of the lease. A security deposit is usually equivalent to one month’s rent.

- Moving services: Whether you are traveling cross country or across the street, the moving process may come at a cost if you end up paying for professional movers or renting a truck.

- Furnishing: Chances are you will need to spend some cash making your space livable and sprucing it up. This may include furniture, bedding and linens, kitchen accessories, decor, and more.

Maintain Utilities

Beyond rent, it’s also crucial to account for utilities. You can expect to pay around $161.88 per month for the utilities for a 915-square-foot apartment in Chicago.

Here’s a more in-depth breakdown of standard Chicago apartment utilities:

- Electricity: Note that the average Chicago renter currently spends about $158 monthly.

- Water: The average water bill every month is close to $40. Keep in mind, though, that landlords typically cover this cost.

- Gas: Tenants can expect to pay around $100 monthly, the average apartment gas bill. However, this number fluctuates significantly depending on the season. Your gas bill will rise as the temperature falls, and vice versa.

- Internet: The average internet bill for one person (60Mbps) in Chicago is $61.15. The internet speed and provider both impact this final number. Regardless, renters often are responsible for paying for this service.

Account for Additional Living Expenses

As you work to budget adequately, prepare your wallet for these additional costs associated with apartment and city living:

- Parking: Apartment parking almost always comes at a cost in the Windy City, and many renters can end up paying a premium for a secure spot for their vehicle. So, if you’ve pondered “how much does it cost to park at an apartment,” anticipate anywhere between $150 to $300 monthly. The price often depends on the type of parking (covered parking, reserved spot, metered parking, etc.).

- Renters insurance: While renters insurance isn’t mandated by Illinois law, your landlord or management company may require a renters policy. Regardless, renters insurance is a wise move and provides coverage for personal property, liability protection, and additional living expenses. This coverage runs about $10 per month in Chicago.

- Pet fees: If you have a furry friend moving in with you, expect to pay extra to have them in the apartment (as long as your building is pet-friendly). Pet owners should budget an additional $300-$600 one-time, non-refundable pet fee or $30-$60 monthly per animal.

Take Advantage of Budgeting Tools

Digital resources have made budgeting more manageable and mindless than ever.

Plenty of apps can help you keep track of your expenses, ensuring that you stay within your budget. Apps like Mint, YNAB (You Need A Budget), or PocketGuard allow you to monitor your spending, set financial goals, and receive alerts for upcoming bills. Implementing these tools into your routine can provide peace of mind and financial stability.

Keep Up With Payments

Along with budgeting, staying on top of your bills is crucial. Late fees can quickly add up and strain your budget.

Consider setting up automatic payments or creating calendar reminders to ensure you never miss a due date. By staying on top of your bills, you avoid extra expenses and establish a responsible and reliable reputation with your landlord, management company or utility providers.

Team Up With An Expert

Knowing how to budget for an apartment can feel overwhelming, especially at a time when costs continue to rise.

Partner with an experienced and licensed real estate professional for more expertise and peace of mind. Our compassionate team can walk you through every step of the process, from preparing your finances to exploring new neighborhoods to signing your lease with confidence.

Connect with one of our knowledgeable brokers today!

Search The Blog

Follow Us on Social

Apartment Experts

NEIGHBORHOODS

View AllUp Next

Chicago Apartment Hunting? Don’t Miss These Summer Move-In Specials on Luxury Apartments

There’s nothing quite like summer in Chicago. The lakefront is buzzing, patios are packed, and the calendar is stacked with festivals, concerts, and rooftop […]

Relocating for Consulting Work in Chicago? Here’s Where to Live

Find your perfect luxury apartment near Chicago’s top consulting firms. Expert tips and neighborhood guides to match your fast-paced lifestyle.

Is a River North Luxury Apartment Right for You? Let’s Find Out!

If you’re looking for a Chicago neighborhood where polished high-rises meet creative energy, you’ll want to check out River North. One of Chicago’s most […]

Landing a Job at a Top Investment Firm in Chicago? You’ll Want to Check Out Fulton Market and River North

Chicago’s finance scene is on fire, and we’re not just talking about the trading floor. From industry giants like Citadel and Guggenheim Partners to […]